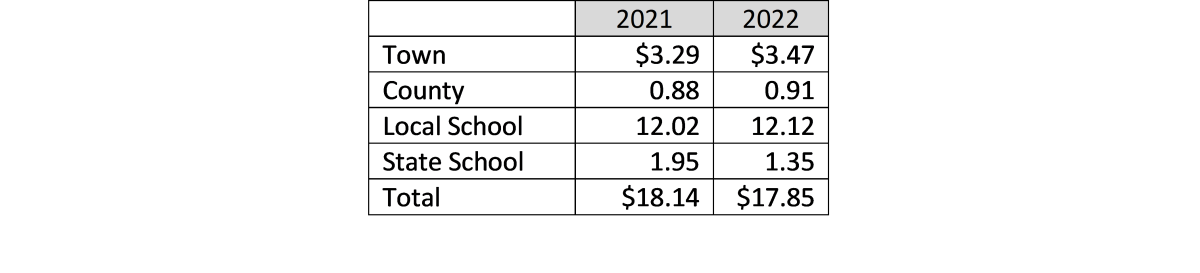

2022 Tax Rate Set

The NH Department of Revenue Administration has finalized the Town’s 2022 tax rate at $17.85 per thousand dollars of assessed value. That is a decrease of $0.29, or 1.6%, compared to 2021.

A few factors go into determining the tax rate:

- The amount needed to cover budget appropriations, as approved by voters at Town and School District Meetings. These are offset by revenues.

- The amount needed to cover State School Tax and County Tax obligations. These are set by the state and county, not locally;

- The total value of property in Town, which increased last year by $8.1Million (0.9%).

The largest factors in the decrease from last year were an increase in school district revenue and a decrease in the required State Education Tax.

Two tax bills are issued each year. The June bill is generally equal to one half of last year’s full year bill. The December bill calculates the full year at the new tax rate. Therefore, this year the second bill will be smaller for most properties.

The tax bills will arrive around November 18th and are due December 19th.

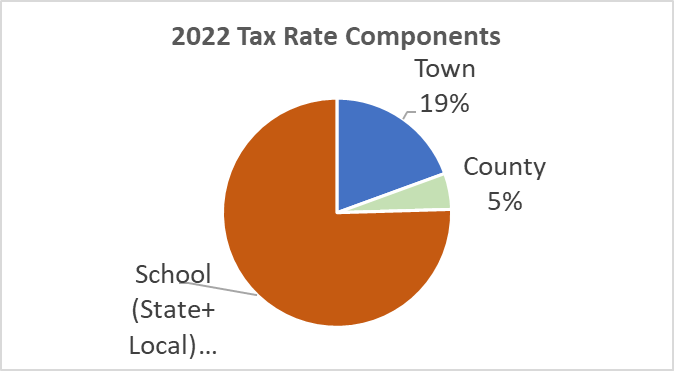

Following is a breakdown of the components of the tax rate: